Notification on Buying and Selling Non-Share Capital Markets Instrument

09.08.2019

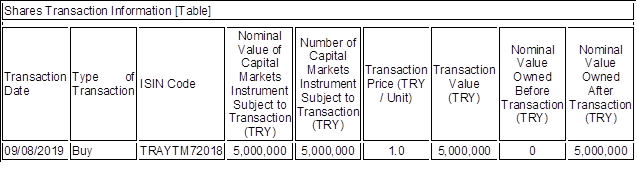

Our Board of Directors have resolved on 09.08.2019 (today);

to acquire 5,000,000 Aytemiz Akaryakıt Dağıtım A.Ş. Financing Bonds (ISIN Code: TRAYTM72018) with a nominal value of 5,000,000 Turkish Liras in return for 5,000,000 Turkish Liras; upon observing that Aytemiz Akaryakıt Dağıtım A.Ş., our indirect subsidiary in which Doğan Enerji Yatırımları Sanayi ve Ticaret A.Ş., the entire capital of which is owned by our Company, has a direct shareholding of 50% in the fully paid up capital of 636,000,000 Turkish Liras, has issued on August 9, 2019 (today) coupon-bearing financing bonds with a maturity of 350 days, and with quarterly instalments calculated taking as the reference quarterly TRLIBOR+1.50% annual simple interest rate (1st coupon term interest rate 5.0847%), that the total nominal value of the issued amount is 50,000,000 Turkish Liras, with a nominal value of 1.00 Turkish Lira, and that the majority of the financing bonds to be issued (90%) has been sold to companies outside the Doğan Group.

The purchase price is the same with the purchase price of the 3rd parties buying in this issuance.

A separate “valuation report” has not been obtained as the transaction amount remains below the criteria set forth in section (a) of paragraph 2 of Article 9 of “”II-17.1 Corporate Governance Decree” of the Capital Markets Board (“CMB”).