Notification on Buying and Selling Non-Share Capital Markets Instrument – Doğan Faktoring

19.09.2017

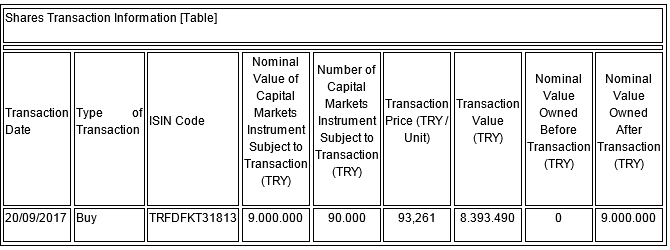

During our Board Meeting dated 19.09.2017, no. 2017/22, it has been resolved to buy, in return for 8,393,490 Turkish Liras, 90,000 shares of the financing bonds, of our direct subsidiary Doğan Faktoring A.Ş., with a nominal value of 9,000,000 Turkish Liras, whereby we have 94.89% shares in the fully issued capital of 20,000,000 Turkish Liras, which shares will be issued and sold outside Borsa İstanbul A.Ş. to qualified investors on September 20, 2017, without holding a public offering, with a term of 177 days, and the discounted selling price is 93,261 Turkish Liras each. The purchase price is the same with the purchase price of the 3rd parties buying in this issuance.

Following the completion of the issuance and the selling procedures, the mentioned financing bonds will start being traded among the qualified investors in the Outright Purchases and Sales Market of the Borsa İstanbul A.Ş. Borrowing Instruments Market.

A separate “valuation report” has not been obtained as the transaction amount remains below the criteria set forth in section (a) of paragraph 2 of Article 9 of “”II-17.1 Corporate Governance Decree” of the Capital Markets Board (“CMB”).